Government Updates – COVID19

Government Updates – COVID19

27 Mar 2020Due to the pandemic of the COVID 19, from this day, a part of our team will be working from home. All documents of March 2020 should be handed over as usual to our offices.

Please contact your accountant as usual to proceed.

Dear Clients, Dear Readers,

Due to the pandemic of the COVID 19, from this day, a part of our team will be working from home. All documents of March 2020 should be handed over as usual to our offices. Please contact your accountant as usual to proceed.

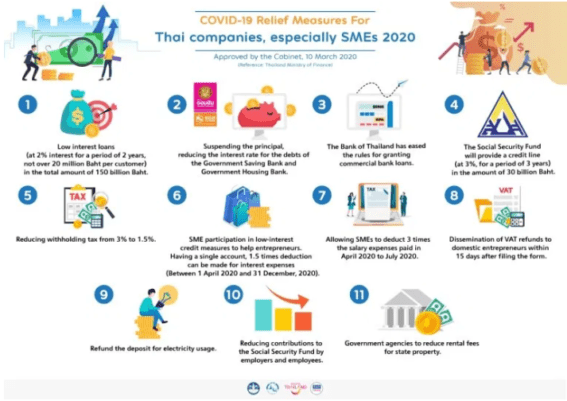

Following the high impact of this pandemic our activities, the government has recently offered the following measures:

Taxation and Social Security Contributions:

- Extension of your Corporate Income Tax (PND 50) filing to the 31st of August 2020.

- Personal Income Tax filing (PND 91) extended from 31st March 2020 to 31st of August 2020.

- Decrease of Social Security Rate from 5% to 1% for employees and from 5% to 4% for employers. The deadlines for paying these contributions has been deferred for 3 months. The contributions of March should be paid not later than 15th of July 2020.

This measure is not published yet on the Royal Gazette so the measure will not apply to March payroll. Any excess contributions may be claimed afterwards. - Reduction of the withholding tax rates from 3% to 1,5% from the 1st of April 2020 to the 30th of September 2020

- Deduction of 3 times wages for salaries less than 15,000 THB per month if the employer does not layoff staff by the 31st of December 2020. It applies to salaries from April 2020 to July 2020.

- Deduction of 1,5% of your loan interest expenses from 1 April 2020 to 31 December 2020.

- Credit Purchase VAT refund in 2 weeks in case of VAT credit. It mainly applies to exporters.

- At that day 27th of March, there is no extension of VAT and WHT filing yet.

Employer responsibilities:

- In case an employee must be quarantined, usual labor law does not apply. The employee must use its annual leave first. In case the credit of annual leave is insufficient, the employer has no obligation to pay the wages corresponding to the period of leave. This is only possible if the employee is not able to work from home.

- Certain types of business have been ordered to temporarily close. For those employers, there is no obligation to pay wages during this period.

- Under section 75 of the Labour Court, if the employer cannot operate normally for reasons other than force majeure, the employer may temporarily suspend the business. In case such situation occurs, the employer can pay 75% of remunerations. The employer must report the temporary closure to the Labor Inspector at least 3 working days in advance.

- By written consent, the employer and employee may both agree to reduce the wages.

- In case the company decides to lay off employees, one month of advance notice and usual rates of severance pay will apply.

We will keep you informed in case new measures are announced. In the meantime, we wish you courage in these hard times.

Best Regards,

Vincent CLOITRE, Founding Partner of B-Accounting Co., LTD

We serve leading businesses operating in Thailand